FTX is a recently formed centralized cryptocurrency exchange that specializes in crypto derivatives and leveraged trading products. Billing themselves as the exchange created by traders, for traders, FTX has rapidly gained prominence and grown to rival the likes of Coinbase, Binance, Kraken and other large, well-known crypto exchanges. With support for hundreds of spot tokens, leveraged tokens, and futures contracts there’s plenty here to satisfy even the most experienced crypto trader. But it doesn’t stop there.

FTX also has a number of innovative features that recommend it as the exchange for any crypto trader.

The following review of FTX will take you through a tour of the products on offer, the supported tokens, the fees you can expect to pay on your trades, and the functionality of the trading platform. Ready to get started? So are we.

Page Contents 👉

- 1 What is FTX Exchange?

- 2 FTX Exchange Review Pros and Cons

- 3 FTX User Experience

- 4 FTX Trading Products

- 5 FTT Token

- 6 FTX OTC Desk

- 7 FTX Quant Zone

- 8 Margin Lending

- 9 FTX Pay

- 10 FTX Mobile App

- 11 Supported Jurisdictions

- 12 FTX Fees

- 13 FTX VIP Accounts

- 14 Deposits and Withdrawals at FTX

- 15 FTX Deposit and Withdrawal Fees

- 16 FTX Review Security

- 17 FTX Insurance Fund

- 18 FTX Account Registration and Login Process

- 19 Who is Behind the FTX Exchange?

- 20 FTX Customer Service

- 21 Is FTX Suitable for Beginners?

- 22 FTX vs Binance

- 23 FTX vs Kucoin

- 24 FTX vs Coinbase

- 25 Conclusion

What is FTX Exchange?

FTX is a fairly new crypto exchange, having been launched in May 2019 by co-founders Sam Bankman-Fried and Gary Wang. The exchange garnered early support with an endorsement from the quant crypto trading firm Alameda Research, which is not surprising, since Bankman-Fried also founded Alameda back in October 2017, though he has since handed the CEO reins along.

With its focus on futures and leveraged trading FTX quickly filled a niche in the crypto trading ecosystem.

Interestingly, one of the early backers of FTX was competing exchange Binance. All the way back in December 2019 they became a strategic backer of FTX. However as of July 2021 the two exchanges have parted ways, likely because of their competing platforms.

Thanks to the fact that the FTX platform was designed by traders, for traders, it is an easy to use and intuitive platform that’s a pleasure for experienced traders and easy to pick up for new traders.

FTX Exchange Review Pros and Cons

FTX is an excellent exchange for beginners who are looking for an easy to understand platform, but it’s also excellent for seasoned traders thanks to its low fee structure, leveraged trading options, and advanced trading features.

|

Pros |

Cons |

|

Low Fees |

U.S. clients have a limited platform |

|

Many tokens to choose from |

Some major coins aren’t listed |

|

Advanced trading features |

|

|

An NFT marketplace |

|

|

The FTX Debit card (FTX US only) |

Pro Exchange

Here’s a closer look at some of those Pros:

Low Trading Fees: One of the primary draws of the FTX exchange is the low trading fees. Maker fees start at 0.02%, while taker fees start at 0.07%. For those unfamiliar with the maker/taker terminology, maker fees are charged on orders that aren’t filled immediately, that is the limit orders that go onto the exchanges order books. Makers get lower fees as a way to incentivize them to provide liquidity. Taker fees get charged to the market orders that are filled immediately. High volume traders and those staking the native FTT token of the exchange get even lower fees.

Large Cryptocurrency Selection: In total FTX has roughly 300 cryptocurrencies available to trade, either on spot or as futures. This is a great selection and FTX continues adding new coins all the time.

Earn on your Holdings: It’s possible to stake several coins at FTX and as of the date of writing this piece one of them pays 20% APY. That’s a pretty decent rate of return, especially since banks are currently paying interest rates of 0.1% or less.

FTX – The Good and the Bad. Image via Medium

Advanced Orders: Besides the basic market and limit orders FTX also has a number of advanced order types to help manage your portfolio and risk. These include Trailing Stops, Take profit market and limit orders, and stop loss market and limit orders. These advanced order types allow you to enter a position and then set all your selling conditions and forget all about the position until it’s closed. It’s very handy not to have to constantly monitor all your open positions.

Margin Trades: Not everyone can access margin trading at FTX, but if your account is over $100k margin trading is enabled. This means you can trade with up to 10x leverage, giving you a more efficient use of your capital. Remember that margin trading is high-risk and isn’t recommended for beginners or even most experienced traders.

The NFT Marketplace: FTX has recently opened a marketplace for buying and selling non-fungible tokens (NFTs). It’s also possible to use the marketplace to mint your own NFTs and then auction them off to other users. As of November 12, 2021 FTX has disabled minting on its international portal, however it’s still possible to mint NFTs at FTX.us, which is available to users inside and outside the U.S.

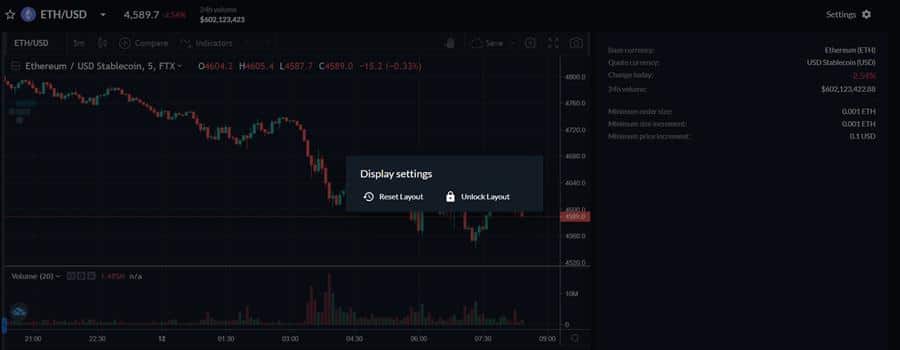

FTX User Experience

The second you land on the FTX homepage you’ll immediately see the amount of effort that the team behind the exchange has put into creating a positive user experience, not only for experienced traders, but for all experience levels. There are a number of customization options such as the sleep interface that will toggle the exchange website between light, dark, and black modes.

Nearly all the information you need about the exchange is accessible from the homepage, even if you aren’t yet a registered client. We loved this level of transparency in a world where so many exchanges try to hide features that prospective clients might not like. But then there’s very little about FTX that you won’t like.

Perhaps one of the greatest customizations is the ability to move elements of the trading platform around to best suit your own style. Note that you do not need to create an account and be logged in for this feature to be active. Simply go to Settings and choose “Unlock Layout”.

Have a specific layout in mind. Unlock and get creative! Image via FTX.com

If you have any questions on how to use various features of the exchange there’s a detailed help section where you’ll find user guides and tutorials explaining every aspect of the exchange platform. And those who trade on the go can download the FTX mobile app (for Android and iOS) and have access to all the same great tools and features everywhere they go.

FTX also supports automated trading through its Quant Zone and the use of API keys to automate trading easily.

FTX Trading Products

Because FTX is primarily a derivatives exchange it means in most cases you aren’t trading the actual asset. That means you can’t buy many of the coins and send them off the exchange to your own wallet. The derivatives offered are simply a reflection of the underlying asset, and so you’re trading on the price.

That said, because FTX is based around derivatives like futures and leveraged tokens they can offer some very unique tradeable products you won’t find elsewhere. Below we take a deeper look into the products being offered by FTX and their features.

FTX Trading Futures

A future is a financial derivative in which two parties agree to trade a specific asset at a future date and at a predetermined price. This allows for some interesting arbitrage opportunities at times, and it also means that traders can benefit from the use of leverage when trading futures contracts. On FTX most of the futures contracts allow for leverage of up to 10x to be applied when trading. That means your gains and losses are magnified 10x. It’s very powerful, but also very dangerous if not used properly.

One of the other benefits to the futures offered at FTX is that many aren’t offered as futures anywhere else. This is particularly true for the lesser known altcoins that have smaller market caps and lower liquidity.

It’s the Futures

As of October 2021 FTX is offering more than 200 different futures contracts on over 100 different cryptocurrencies. These futures are near dated (2 months), further dated (5 months) and perpetual. In addition to individual cryptocurrencies there are also a number of indices that can be traded as futures. Very powerful stuff.

Note on Perpetual Futures: These are futures contracts that do not expire. Instead, the price of perpetual futures is updated every hour to keep pace with the value of the underlying asset.

FTX Options

Options are another derivative product available on FTX. These are similar to futures, but don’t require the holder to actually purchase the underlying asset when the option expires. Rather options give you the right to buy or sell an asset at a specific price. You are not obligated however and can freely allow the option to expire without exercising it.

Currently FTX only offers a Bitcoin option. It’s also possible to design your own options contract and then request a quote on the exchange. If you do this FTX says it will give you the first offer in no more than 10 seconds. Once you receive the offer you can choose to accept it, or decide not to trade. You are also free to wait for additional offers to come in. The request for quote lasts for five minutes, and if you haven’t accepted an offer by that time it goes away.

FTX Leveraged Tokens

Leveraged tokens are one of the unique offerings being pioneered by FTX. These leveraged tokens are ERC-20 tokens that reflect the actual price of the underlying tokens, but with a leveraged component to allow traders to use their capital more efficiently.

For example, one of the leveraged tokens is the BULLUSD, which is basically a long BTC token that also includes leverage of 3x. That means for every 1% move in BTC the BULLBTC token moves 3%. So, a 1% BTC increase equates to a 3% BULLBTC increase. The same is true for declines, with a 1% BTC decline equaling a 3% BULLBTC decline.

Leveraged Tokens can be Very Powerful

Currently there are four flavors of leveraged tokens available at FTX:

- BULL is +3x leverage

- BEAR is -3x leverage

- HEGDE is -1x leverage

- HALF is +0.50x leverage.

Let’s look at Cardano (ADA) as an example. If ADA goes up 1% in a day, then:

- ADABULL goes up 3%

- ADABEAR goes down 3%

- ADAHEDGE goes down 1%, and

- ADAHALF goes up 0.50%.

The BULL, BEAR, and HEDGE tokens automatically rebalance themselves throughout the day to maintain the target leverage. In other words, if you made a profit, the tokens will reinvest the money. If you lose money, the tokens will sell some of the position to reduce its leverage.

This ensures that you avoid liquidation risk while trading with leveraged coins. Moreover, as the rebalancing is automated, it saves time and effort from the trader’s side to manually manage their exposure.

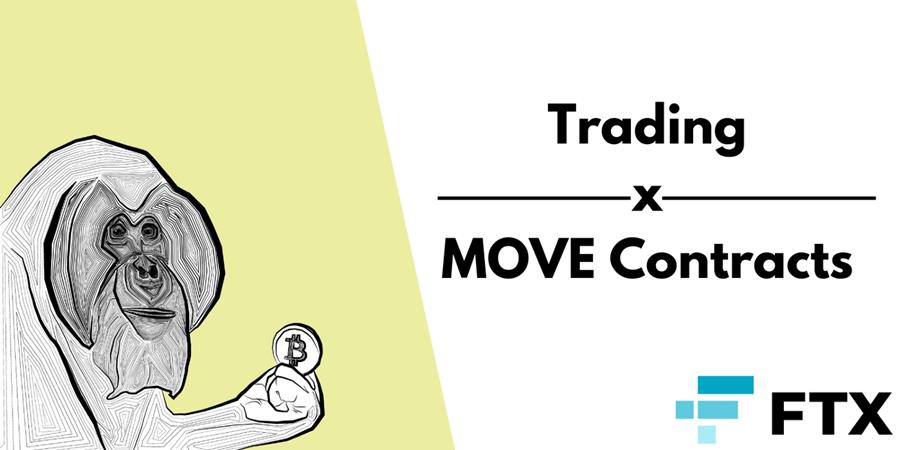

FTX Exchange Volatility Contracts

FTX has a number of volatility based derivatives that allow traders to trade on the volatility in the markets. This can be done strictly for profits or it can be used to hedge other open positions. There are two volatility based products available on FTX – the MOVE contracts and the BVOL tokens

FTX Trading MOVE Contracts

The MOVE contract is another unique and innovative product that can only be found at FTX. Basically the MOVE contract represents the movement of an asset over a specified period of time, making it a way to speculate on the volatility of various assets.

As an example, if BTC moves $100 over a 1-day period, the MOVE contract is then valued at $100.

Long MOVE contracts are best when you believe an asset is going to make a significant move in either direction, while short MOVE contracts are best when you believe the price of an asset will remain relatively stable.

FTX offers MOVE contracts on three different time periods.

Daily: These expire after a single day.

Weekly: These expire after a seven-day period.

Quarterly: These contracts expire after a three-month duration.

MOVE contracts speculate on volatility. Image via Medium

Similar to other tradable assets we have discussed thus far in this FTX review, MOVE contracts can also be traded with leverage.

FTX Exchange BVOL Tokens

BVOL tokens track the volatility in Bitcoin. They are ERC-20 tokens and they get their price data from the FTX MOVE contracts and BTC perpetual futures contracts.

BVOL tokens can be used to go either long or short the market, depending on where you think the price of Bitcoin is headed and how strong the move will be. BVOL tokens reflect the daily returns of 1x long volatility of BTC. Whereas iBVOL (Inverse BVOL) reflects the daily returns of 1x short the volatility of BTC.

FTX Spot Markets

While the primary focus of FTX is on derivatives, that doesn’t mean you can’t also get some cryptocurrencies on the spot markets as well. This means you are buying and selling the actual cryptocurrency rather than some financial derivative where you are simply speculating on the price movements of the underlying.

As of October 2021 FTX features spot markets for 65 different cryptocurrencies across more than 200 trading pairs. Most of the pairs are USD or USDT, but there are also a few EUR, BRL, and TRY pairs featured.

FTX Prediction Markets

The prediction markets on FTX are akin to the traditional betting setups. Rather than speculating on some financial asset, with the prediction markets you are speculating on the outcome of some real-world event. If your prediction is right you win, and if your prediction is wrong you lose your stake, or bet.

Can You Make the Correct Guess?

Not surprisingly, one recent prediction market was for the 2020 US Presidential election. The exchange allowed users to place trades on contracts named after the different election candidates – such as TRUMP for Donald trump, BERNIE for Bernie Sanders, and BIDEN for Joe Biden, among others.

In October 2021 there is a prediction market speculating on whether Donald Trump will win the U.S. presidency in 2024 and another that’s betting on whether or not Jair Bolsonaro will win the 2022 Brazilian Presidential election.

Such prediction markets are an interesting way of trading outside the traditional norms of cryptocurrency exchanges.

FTX Crypto Exchange New Products

FTX doesn’t just sit on its successes, it is actively looking to constantly expand on its offerings and products. In that vein, two of the more recent additions to the platform are stock and index trading, as well as fiat currency trading. In both cases there are some spot markets and a number of futures contracts that can be traded.

New Can be Very Good

In the stocks category some interesting names available include Tesla, Amazon, Apple, and Facebook. All are available as tokenized assets or as futures.

With the focus on innovation and the trader at FTX it is quite likely we will continue to see new assets and even new tradable products added over time.

FTT Token

FTX is similar to other crypto exchanges in that it’s released its own native token that is the backbone of the FTX ecosystem. And another similarity in this token, which has the ticker FTT, is that it has rapidly jumped into the top 50 cryptocurrencies by market cap. This is partially based on the utility of the token, which can help users save on exchange fees, but it’s also based on the plans FTX has to burn half the token supply to create scarcity.

Of course FTT is available to trade from other exchanges too. You’ll find it listed on Binance, Huobi, and Kucoin among others.

Apart from its use as a tradable financial asset FTT is used on the FTX exchange to bring a number of benefits to its holders. Lower trading fees are one expected benefit, but users can also realize socialized gains from the FTT Insurance fund. The token can be staked for yield, and can also be used as collateral for futures trading at FTX.

Since the start of 2021 FTT has returned roughly 1,000%, going from the $6 range to the $60 range as of late October 2021.

FTT Staking

As mentioned above, one of the benefits that FTT holders get is the ability to stake their tokens for yield and additional rewards.

Staking FTT yields more than just $.

- Improved maker fee schedule: Stakers have a separate maker fee schedule that overrules the normal fee schedule. This is in addition to the standard FTT discounts.

- Bonus votes: FTX often takes polls from traders before launching a new financial instrument on the site. For instance, until January 11, 2021, traders could vote on which tokenized stock groups FTX should list next. FTT holders get additional votes on such polls.

- Increased SRM airdrop rewards: SRM is the native token of the Serum ecosystem. FTX is committed to dispersing 5% of the total supply of SRM to FTT holders over time.

- Increased referral rebate rates: In FTX’s affiliate program, traders who stake FTT receive a higher percentage of their referee fees.

FTT Exchange

Even though the FTT token is the native token for the FTX platform it doesn’t mean that you can’t exchange FTT at other cryptocurrency exchanges. As of the writing the FTT token is tradable at Binance, Huobi Global, KuCoin, and a large number of other small exchanges. Given that prices for tokens vary from one exchange to the next this means you might be able to get some FTT tokens at a discount elsewhere and then transfer them to FTX to secure all the benefits provided by holding and staking FTT tokens.

Note: FTT token is not accessible in the United States, or any other restricted jurisdictions. If you reside in one of these locations, you are not permitted to transact in FTT tokens.

FTX OTC Desk

FTX also caters to institutional traders looking to buy or sell large blocks of crypto assets through its Over-the-Counter (OTC) exchange service. While this is a commonly offered service, FTX has improved on the process to make it easier to navigate and more cost-effective as well.

The portal to access the OTC market can be found at otc.ftx.com and users can log in using the same credentials they have for the main FTX platform. This allows for access to instant OTC quotes on most major cryptocurrencies. The OTC platform features no fees, tight spreads, and lightening fast settlements.

FTX Over-the-Counter for Large Traders

Depositing and withdrawing from the OTC platform is simple since it’s connected to the main FTX wallet. Enjoy deep liquidity and no fees outside the spread.

FTX Quant Zone

Another great feature of FTX is their Quant Zone where users are able to build and share their own trading strategies. Given the background in quant shared by the founding team you’d expect this feature to be quite strong, and you wouldn’t be wrong.

The Quant Zone allows users to create their own predefined set of trading rules, and then automate trades on FTX based upon those rules. While this alone is nothing unique, you can find it on many platforms, FTX has added a number of customization options and flexibility to the rule set.

As an example, with the Quant Zone it’s possible to design rules using the price action, triggers, and other monitoring rules. And it’s also possible to string together multiple conditions for each rule that’s created.

There’s no limit on the rules you can create, and they can be enabled and disabled as needed.

Once rules are created and enabled they will look at the market every 15 seconds to determine whether or not the conditions specified in the rule are now met. If the trigger for the rule is true when checked the action or actions included in the rule are then executed. This goes on until you pause or disable the rule. And if you have multiple rules enabled they will all continue running simultaneously until they are paused or disabled.

Margin Lending

This is a really unique and interesting feature offered by FTX to add another arrow in the quiver of what makes the FTX Exchange one of the fastest growing and most popular crypto exchanges available. Margin lending is an option where users can lend out their cryptocurrency to other users on the FTX exchange, enabling them to borrow funds to use for their margin trading, paying the lender interest in return. Essentially, users on the FTX platform can enable their balance to be borrowed by someone else, earning some annualized interest paid hourly for the duration that their crypto is lent out. This option can be enabled and disabled at any time without delay if a balance is not currently being borrowed, but it can take up to 6 hours for your funds to be released and returned to your account if they are being borrowed.

Users can choose to lend their spot holdings for the different coins supported by the FTX exchange, allowing them to benefit from upside market volatility, or they can choose to minimize volatility risk as much as possible by only lending their fiat balance or stablecoin holdings. Users can only lend their tokens if there is someone willing to take up the lending offer and agree to borrow those funds. FTX states that there is little to no risk to the lender as the borrower needs to have sufficient margin available to borrow and FTX’s risk engine will attempt to liquidate any user before they could incur a negative net account balance. FTX and its backstop fund will attempt to protect users against other accounts’ bankruptcy risk. The only other risk to consider would be if the lent asset significantly dropped in value while it was lent out leaving the lender unable to sell the funds.

To use the margin lending feature, users will first need to enable the option for “spot margin,” in their account settings. Once that is done, they will be able to see the option for “margin lending,” from their wallet screen and then they will be able to see a list of all the assets available to lend to other users. Lenders then need to choose the quantity they want to lend and the minimum interest rate they require, if the loan ends up being accepted, the lender receives the marginal interest rate hourly.

Lending can provide a good APY by the hour, but there are not always users wanting to borrow and lenders should keep an eye on fees and rates on various coins as they can fluctuate so to make the most of this feature users will need to be quite active in monitoring the lending/borrowing screens. This feature has a lot of potential and as crypto user adoption grows more people will be using the FTX platform, there will be more options for lending/borrowing opportunities. This is a great and easy way to make a bit of side income. To learn more about how the lending and borrowing works and see some examples check out the FTX help article on lending/borrowing here.

FTX Pay

FTX Pay is a widget that can be integrated into websites and e-commerce sites or apps which allow users to get paid in or pay in crypto and also supports fiat payments. It is fully customizable and allows users to receive payments according to their requirements using FTX’s fast and secure, low-fee payment processor.

Note that FTX Pay is moving to FTX.US which is available for users outside the USA. Current FTX users can continue to use FTX Pay but new users will need to access this feature through FTX.US. Be sure to check out our FTX.US exchange review.

FTX Pay is Making Crypto and Fiat Payments Easy Image via ftx.com/pay

FTX Mobile App

No FTX exchange review would be complete without mentioning their mobile application. One of the things that stands out with the FTX website is the beautifully designed, easy to navigate, intuitive and functional layout and the FTX mobile app meets the high expectations and functionality that users have come to expect from a leading exchange, the app does not disappoint.

As many crypto users are on the go, it is important to be able place and monitor crypto trades, positions, holdings and make modifications whenever and wherever we are. As we all know, the crypto markets move fast so the ability to access your account on the go is a must. The app provides users with the ability to buy and sell crypto, stocks, NFTs and has become one of the most popular crypto applications for investors as the app was previously known as Blockfolio, a popular crypto portfolio tracking app before being acquired by FTX in 2020.

The FTX app currently supports over 10,000 cryptocurrencies for data tracking and receives market data compiled from over 500 different sources meaning that traders will always be getting the most accurate and up to date price feeds and data. The application provides users with the ability to purchase some crypto-assets such as Bitcoin, Ethereum and Dogecoin with fiat currency and users can track and manage their portfolios with precision and ease. The “Track” tab allows users to organize their holdings and create watch lists so they are always in the know for matters regarding their favourite crypto assets and portfolios. Once a portfolio is set up it can be linked to a user’s exchange enabling the portfolio to be updated in real-time as users buy and sell positions.

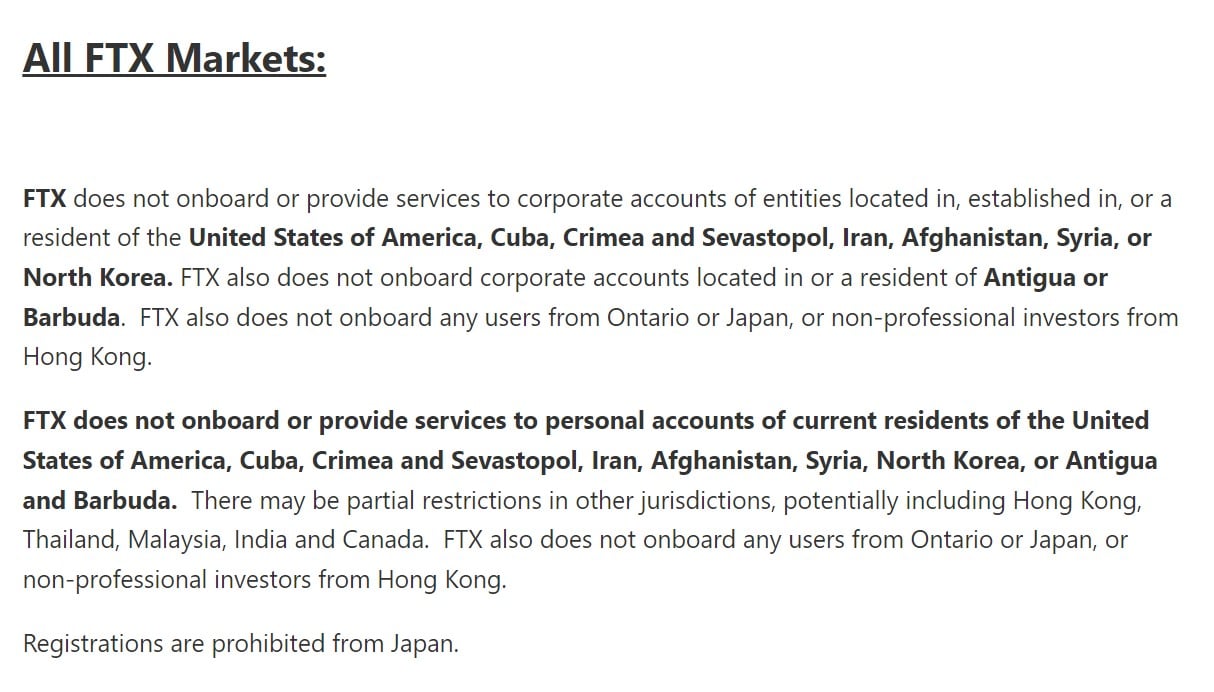

Supported Jurisdictions

While FTX is a global exchange, there are a number of jurisdictions where the platform is not legally available due to sanctions or other regulations. The following is a list of the countries where FTX is NOT accessible:

- Cuba

- Crimea and Sevastopol

- Syria

- Iran

- North Korea

- Antigua, or Barbuda

FTX Exchange USA

In addition, residents of the United States are not permitted to use the main platform at FTX.com, however the exchange has made accommodations and created the FTX.us platform specifically for those U.S. users. That platform has a more limited selection of cryptocurrencies and volatility products, but otherwise it functions in the same way as the primary FTX platform.

FTX Fees

As with any exchange there are several trading fees and commissions to be aware of when trading at FTX. The information and charts below will give you a better understanding of these fees and commissions.

FTX Taker and Maker Fees

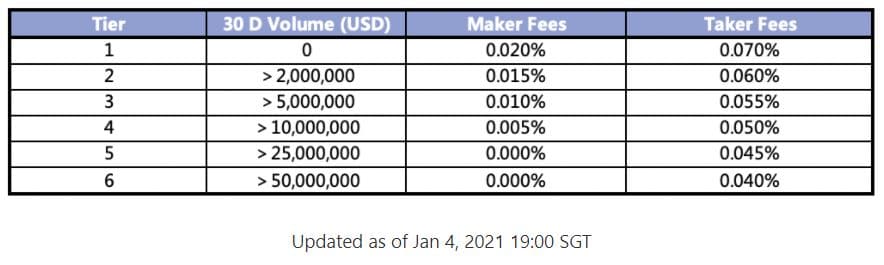

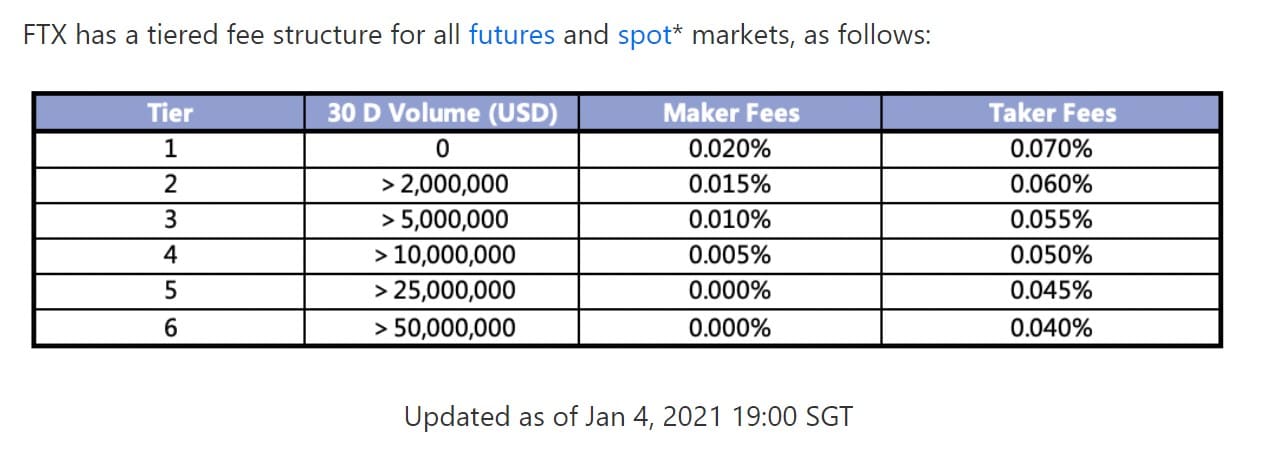

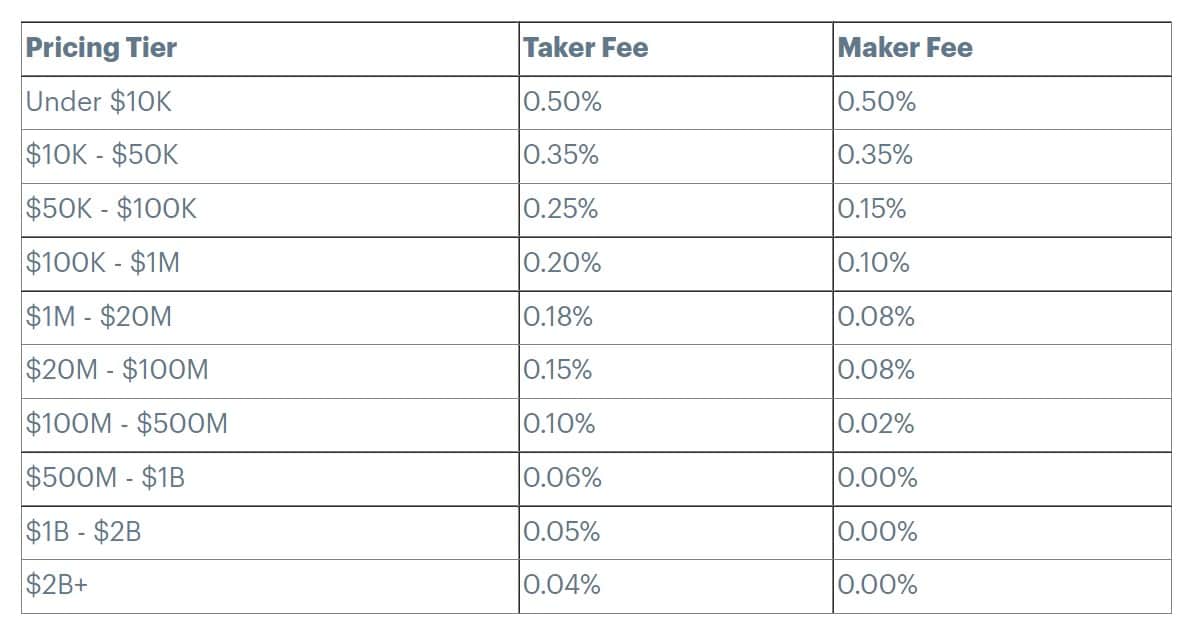

Like many of the crypto exchanges FTX uses a tier-based fee structure for the assets in its spot and futures markets. As you can see from the chart below there are six tiers and fees are adjusted lower based on the 30-day trading volume of the user.

Tier 1 traders have to pay a taker fee of 0.07% and a maker fee of 0.020%. On the other hand, the highest tier – tier 6, comes with a 0.040% taker fee and a 0% in maker fee.

As you can see, the maker fees are lower. This is commonly done in order to encourage a larger order book, and increased liquidity, on the exchange.

FTX Exchange Fees

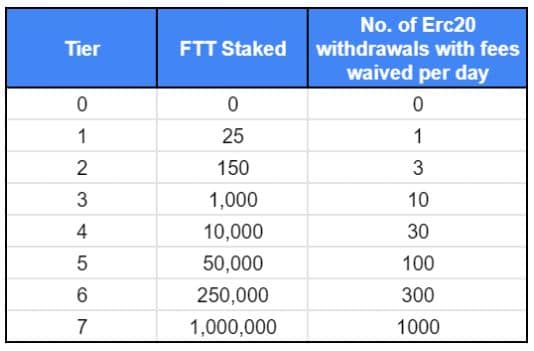

In addition to the trading fees there are some other minor fees to consider when using FTX as your cryptocurrency exchange. Fortunately there are no deposit or withdrawal fees, unless you are transacting with small amounts of BTC, or if you’re transacting with ETH and ERC-20 tokens. That said, the fees for ETH and ERC-20 tokens can be waived for those staking FTT.

In addition, there are no fees on futures settlement at FTX. Leveraged tokens have creation and redemption fees of 0.10%, and daily management fees of 0.03%.

FTX VIP Accounts

If you fancy yourself a professional trader you’ll be happy to know that FTX has a special VIP account waiting for you with a number of perks that aren’t offered to the everyday retail trader. These perks include:

- Lower trading fees

- Dedicated account managers

- Flexible API limits

- Direct access to senior developers

- An option to provide inputs on new FTX products

- FTX customized VIP swag and access to VIP meet-ups

- Admin whitelisting of withdrawal addresses

Become an FTX VIP. It’s as good as going to the MOON!

Requirements

In order to qualify for VIP1, you need to either have a 30-day volume of at least $150m, or a 30-day maker volume of at least $40m.

In order to qualify for VIP2, you must constitute at least 5% of 30-day exchange volume.

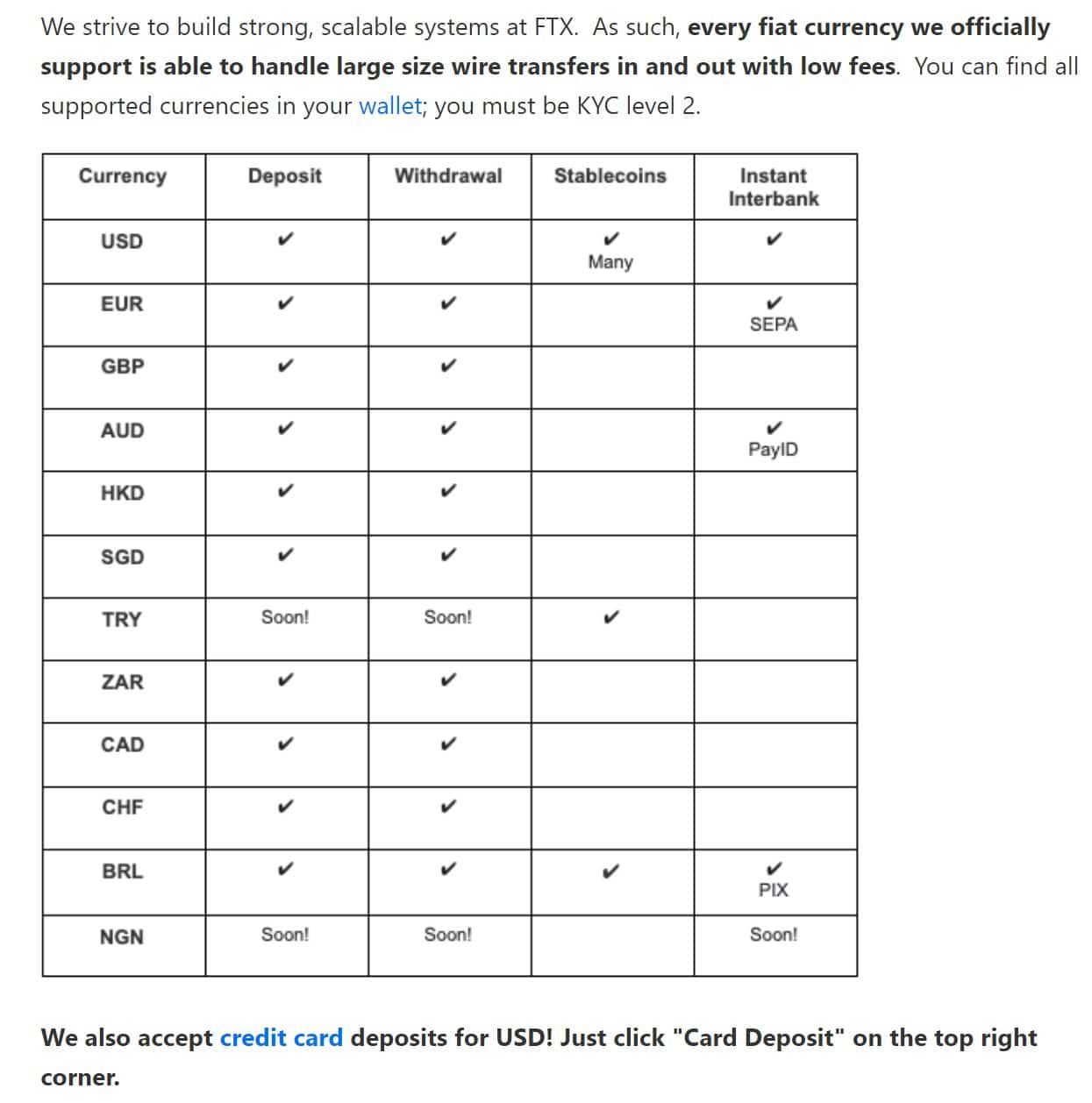

Deposits and Withdrawals at FTX

As a global exchange FTX supports deposits and withdrawals in a number of fiat currencies. These currencies are currently as follows: USD, EUR, GBP, AUD, CAD, CHF, HKD, SGD, and ZAR

In addition users are always able to make deposits in all of the following cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Binance Coin (BNB), Litecoin (LTC), FTX Token (FTT), BitMax Token (BTMX), BiLira (TRYB), USD Stablecoins (USDT, USDC, TUSD, PAX, HUSD, and BUSD).

FTX does not charge any fees on crypto deposits and withdrawals, and they even go as far as to cover the transaction fees on crypto withdrawals. However, fiat withdrawals under $10,000 are subject to a $75 fee. All withdrawals above this amount are free from fees.

All wire transfers are processed on weekday evenings (Monday-Friday) at FTX (except Silvergate SEN). Wire transfers in USD can take up to 24 hours to process, while transfers in any currency besides the USD can take up to several business days.

Users are able to easily make both deposits and withdrawals in fiat directly from the FTX wallet. It’s also possible to convert from other currencies to USD stablecoins within the FTX wallet by choosing the ‘CONVERT’ button that’s located in the wallet.

All fiat transfers are handled via a third party OTC desk, and dealing in fiat is only available to users who are Level 3 KYC verified. The FTX team encourages users to get in touch before depositing or withdrawing fiat for the first time, and have also produced a video walk-through to explain the process.

FTX Deposit and Withdrawal Fees

As discussed above, there are no fees associated with any cryptocurrency deposits or withdrawals at FTX. In the event of fiat withdrawals any withdrawal above $10,000 is free of fees, but withdrawals under that amount are subject to a $75 processing fee. There are no fees associated with fiat deposits.

Note that when your deposit or withdrawal exceeds your trading volume, the exchange can charge you a fee of up to 0.10%. FTX will reach out to you in case you are liable to pay this fee.

Other FTX Fees

Futures Settlement: FTX charges no additional fees for futures settlement.

Spot Trades: Fees on spot trades are deducted from the asset you receive. For instance, if you place a buy order on BTC/USD, your spot trading fees will be charged in BTC. If you place a sell order, the fee will be charged in USD.

Leveraged tokens: It costs 0.10% to create as well as redeem a token. In addition, you are also liable to pay a daily management fee of 0.03%.

Perpetual Contracts: The platform charges a funding fee on perpetual contracts. However, this is not kept by the exchange. Instead, the funding fee will be paid to holders at the other end of the contract.

Fees on Leveraging: Leverage fees will also apply. For example, leverage of 50x increases your trading fee by 0.02%. With leverage of 100x, the trading fee will rise by 0.03%. These additional fees are paid to the insurance trading fund. However, this fee is not applicable if you are leveraging BTC and ETH perpetual contracts.

MOVE Contracts: Fees related to MOVE contracts depend on the price of the underlying asset.

HTT Holders Discount: As we covered earlier, FTT token holders will also receive additional discounts on trading fees. The extent of this reduction will depend on the amount of FTT you hold.

FTX Review Security

Security is always a top concern when dealing with cryptocurrencies, and FTX takes the security of its platform extremely seriously. One of the steps they’ve taken is to provide the FTX wallet for each user to have a secure place for storing their digital assets.

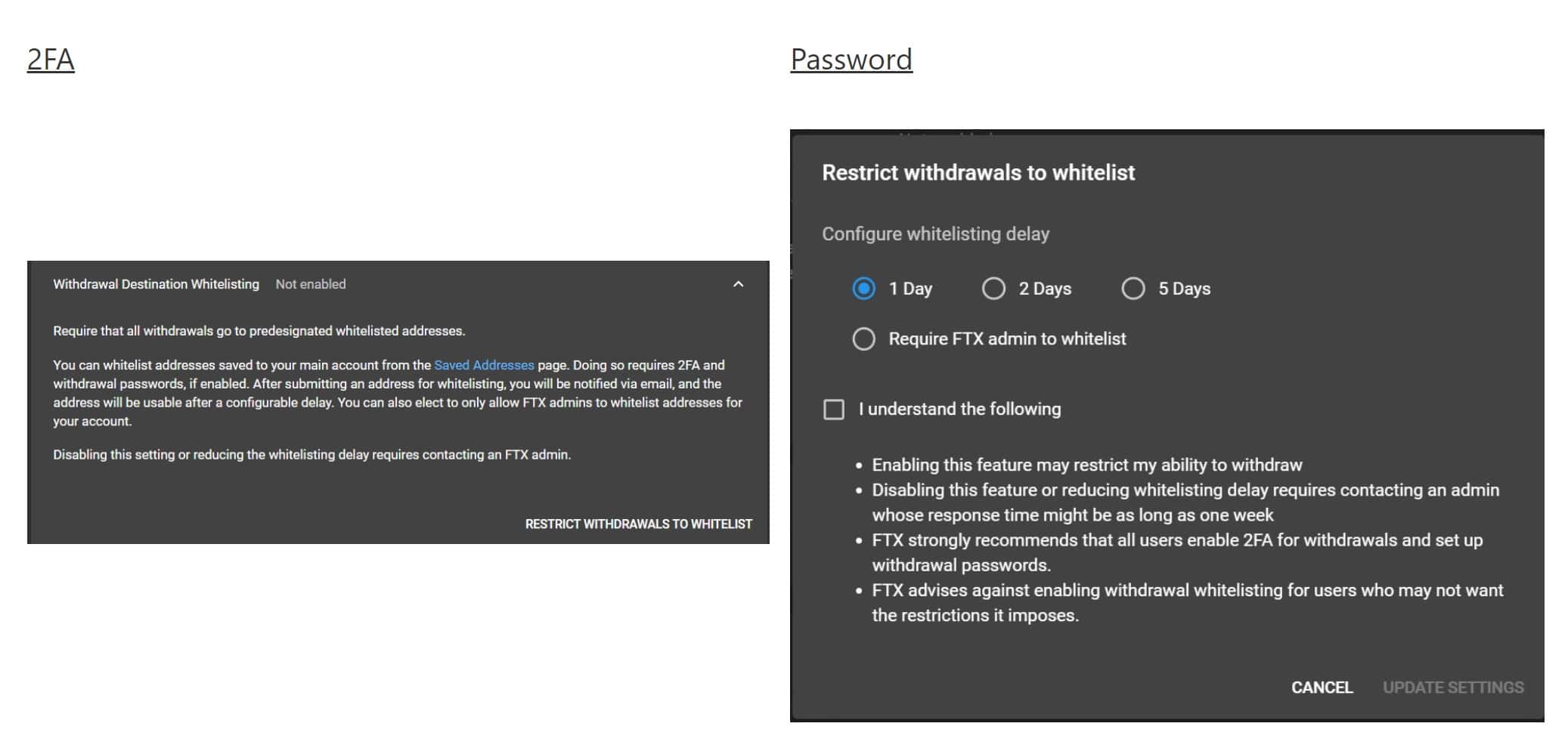

2-Factor authentication is available and highly encouraged. This type of authentication requires a code, which is generated within a third-party app on the user’s device, to be used when accessing trading funds and when making withdrawals. FTX also has a requirement for minimum password complexity which is a good thing so users cannot simply use “password” as a password, which is just asking for trouble.

FTX have also taken additional steps which allow users to enable 2FA for withdrawals and have added an optional withdrawal password. This is a great second line of defense, if somehow your password to login gets compromised and someone gains access to your account, they will not be able to withdraw any funds without using an additional 2FA and a withdrawal password if these features are enabled. Users should take full advantage of these additional security features if they want to turn their FTX exchange account into the Fort Knox of safety.

Utilize Additional Security Features to Keep Your Account Safe Image via shutterstock.com

There is also a feature to have a 24-hour lock placed on the account any time there is a 2FA removal or password change. This is also a smart feature to have and will leave bad guys really banging their head because in the unlikely event they go through all that work and manage to break into your account and remove the need for a withdrawal password or 2FA, now they need to wait 24 hours before they can do anything, and as these shenanigans are going on the user would have been notified of these actions via email so they have 24 hours to go in and secure their account without losing any funds. Anytime there is suspicious activity on a users’ account such as unusual login attempts, or there is a login attempt without the 2FA, FTX will notify the owner so they can take necessary precautions.

Additional Security Features

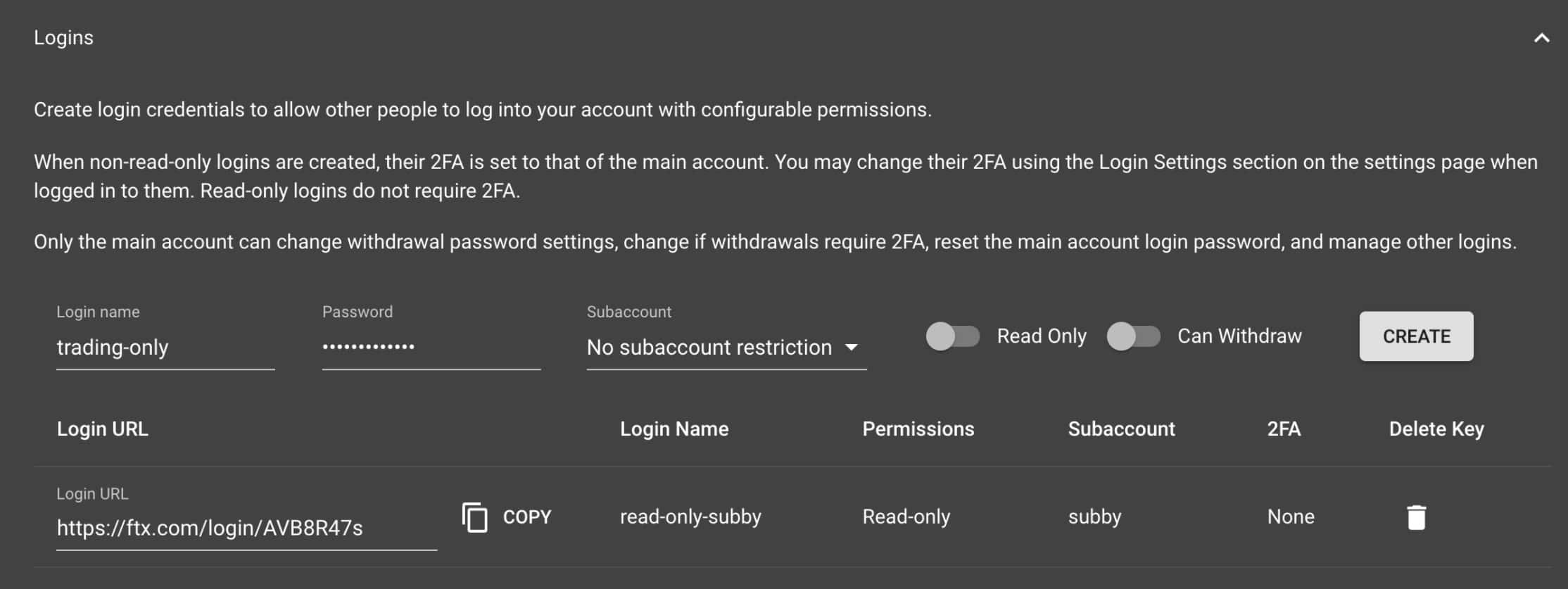

Subaccount Login Features– FTX allows users to create custom logins that they can use to allow other people to log into their account with configurable permissions. This is quite unique and interesting, not to mention handy for any two or more people who want to share an account, or if someone wants someone else to be able to make trading decisions on their behalf. Users can set the subaccounts to be read-only, or set withdrawal permissions for withdrawals on the blockchain, to OTC, or transfer between subaccounts.

Subaccount Setup Screen Image via help.ftx.com

Whitelisting IP’s– FTX users can whitelist certain IP addresses when setting up their API Keys. IP addresses can be set to read-only, withdrawals enabled, internal transfers between subaccounts and for API keys to only be useable from a specified IP address.

Whitelisting Wallet Addresses– This is one of my favourite features and is almost enough to make me wish some bad actor would spend hours hacking into my account to finally gain access only to find that they can only withdrawal to a whitelisted wallet address, which of course, would be my own wallet address…Foiled again, bad guy! This feature allows users to only select certain crypto addresses that are allowed for withdrawals from a user’s FTX account. Adding or disabling this feature requires the confirmation of 2FA and withdrawal passwords if they are enabled.

User Settings for Whitelisting Addresses Image via help.ftx.com

Exchange Security Features

Chainanalysis & Manual Review- FTX has recently collaborated with Chainanalysis to monitor suspicious cryptocurrency transaction alerts in the Chainanalysis Know Your Transaction (KYT) product which is a real-time anti-money laundering compliance solution. This paired with a manual review of large or suspicious deposits and withdrawals adds for another layer of safety while using the FTX Exchange.

Backstop Liquidity Fund- The FTX Backstop Liquidity Fund holds approximately $200 million USD and is on reserve to compensate for losses that were not deemed to be the fault of the user.

Based on the information from the FTX website the company is constantly working with researchers and security experts to ensure the security of all its products and services. You can find the detailed security section of the Help articles here.

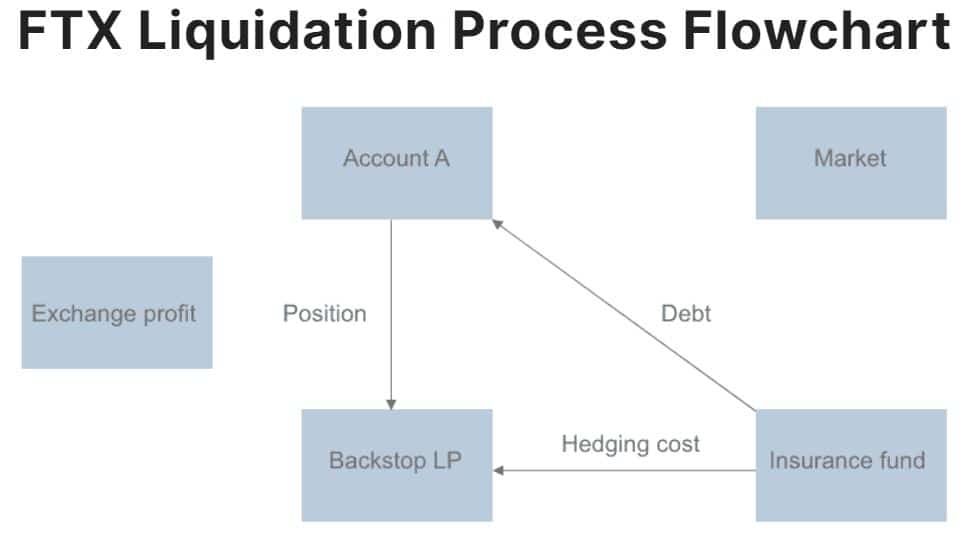

The company also has a liquidation engine that protects against clawbacks and negative balance situations for users.

The liquidation Process Keeps Traders Safe.

Overall we can tell that FTX has put serious thought and resources into the security of its exchange and wallets. To date FTX has not suffered any serious security breaches or hacks, nor has it been subject to any malware threats or clawbacks on user accounts.

It is clear that FTX has enough protocols and systems in place for the security of its traders.

FTX Insurance Fund

With leverage that goes as high as 101x on some assets it makes perfect sense that FTX would have some type of insurance against catastrophic losses. Indeed they have created just such an insurance fund, and it can be accessed in the case of a liquidation event.

Traders taking advantage of leverage do pay slightly higher trading fees, with the excess being shifted to an insurance fund that is used to protect against negative balance situations.

In the event that the FTX liquidation engine fails, this insurance fund will be used to pay out traders who were forced to close their positions at a loss. For instance, an unforeseen and a sudden fall in the price of Bitcoin could trigger the activation of this insurance fund.

In the event that this insurance fund proves to be insufficient to pay clients, FTX has set aside around 5% of non-FTX owned FTT tokens as a contingency.

The FTX insurance fund has historically increased in size during periods of high volatility. These additional returns are divided among FTT token holders as ‘socialized gains.’

FTX Account Registration and Login Process

In case you’ve made it this far and are now interested in creating an account at FTX the following section will walk you through the registration and login process step by step. For those who are more visually oriented you can also find a step-by-step guide to FTX from our own Guy.

As you’ll see, the registration process is quite straight-forward and easy to complete. Like many other aspects and features, FTX has made the registration process as simple as Possible.

- Click on the “Register” tab at the top right of the home page.

- Fill in your name and email address.

- Enter a secure password.

- Complete the captcha and click the checkbox to agree to the T&C.

- Click on “Sign Up” in the pop-up registration window.

- Check the email inbox for a confirmation email.

- Verify email address.

- Click on “Account Security” and select Google Authenticator or SMS for authentication.

- Deposit funds and get a maximum withdrawal limit of $1,000 prior to the KYC verification.

- If you’re interested in higher withdrawal limits click on the “Settings” tab and complete the KYC verification process.

FTX KYC Requirements

FTX does not have a requirement to complete the KYC process to trade though them, however is does provide benefits in terms of trading limits and withdrawal limits. Here are the trading limits for each tier of KYC approval:

For Tier 0 – you only need to provide an email address to start trading. But, your limits will be capped to $1,000 per day.

For Tier 2 – you have to provide your country of residence, which gives you a trading and withdrawal limit of $2,000 per day.

For Tier 3 – you have to provide a photo ID, proof of address, and source of income. This will result in unlimited trading volumes and withdrawal requests.

Who is Behind the FTX Exchange?

FTX was founded in 2018 by current CEO Sam Bankman-Fried who was once a trader on Jane Street Capital’s international ETF desk, and current CTO Gary Wang, who is a former Google software engineer.

Bankman-Fried and Wang

Prior to founding FTX, in 2017 the pair founded Alameda Research Ltd which is a leading quantitative trading and cryptocurrency liquidity provider, and Alameda assists FTX in maintaining deep order books as well as 24/7 OTC services. As of October 2021 Sam Bankman-Fried has stepped down from his role at Alameda, citing his lack of time to devote to the position.

Alameda also incubated and developed FTX with the exchange successfully raising a total of $8m over three funding rounds. After the Seed and Corporate rounds which took place in 2019, the Series B round was completed on March 2, 2020 and attracted investment from Liquid Value Capital.

Binance acted as a Lead Investor during the Corporate round while FBG Capital, Greylock Partners, Kenetic, One Block Capital, and Proof of Capital were all Seed round investors.

As a result, the exchange is backed by a number of leading crypto venture funds and has a strong network to rely on. The core team behind FTX is also transparent in nature and has made their names and LinkedIn profiles publicly available. FTX exchange is owned by FTX Trading LTD, which has been incorporated in Antigua and Barbuda and retains offices in Hong Kong.

What does FTX stand For?

Bankman-Fried and Wang avoided getting fancy or cute when naming their new exchange. The ‘FTX’ term is simply an shortened form for ‘Futures Exchange’, which is exactly what FTX started as.

FTX Customer Service

Customer service, or rather the lack of it, has long been a complaint for crypto exchange users. FTX is trying to change that and has made it possible to contact their customer support team via a number of different channels. These include the usual direct email route, and a live chat box in the help section of the site.

Speaking of the Help section, FTX has made an effort to develop a comprehensive self-help portal that is there to answer most of the common questions that new (and experienced) traders might have.

There is also a notable social presence on Twitter, Facebook, and Youtube and users can also take advantage of Telegram and WeChat groups in a number of languages to get answers to their questions.

All of that is very nice, however we should note that FTX still has a Trustpilot score of just 2.2 of 5 stars. That indicates they haven’t been quite as successful as they might like in transforming customer support for the crypto exchange industry.

Not so Great Customer Service

FTX Support

Perhaps if these exchanges simply went back to the old fashioned method of providing phone support, and enough knowledgeable agents to answer said phones, the support ratings would go up significantly.

Is FTX Suitable for Beginners?

That’s a very good question because, let’s be completely honest, trading in derivatives, particularly with leverage and automation, is a complex and risky proposition, even for those with experience in financial markets and trading.

When you consider the background of Bankman-Fried and Wang, and the features that are offered at FTX, it’s pretty clear that the exchange was not created with beginners in mind. After all, trading in derivatives, options, and futures, not to mention leveraged tokens and automation, requires deep knowledge of financial markets, and extensive experience.

With that in mind it’s very difficult to recommend FTX for beginners IF they plan on coming to the exchange with the intent for using leverage.

However if you’re a beginner and plan on trading the spot markets at FTX, or trading the derivatives without using any leverage, then it’s certainly worth checking out FTX. They’ve got a great platform and low fees, so you would definitely be remiss if you didn’t consider using them in a responsible manner.

FTX vs Binance

Users would be hard-pressed to find anything overly terrible with either Binance or the FTX exchange. Many traders see Binance as the “OG” in the space, being tried and battle-tested over and over for years, while FTX is like the shiny new kid on the block and is known for being highly innovative and is often considered the “next generation,” of crypto exchanges.

Supported Jurisdictions and Regulation Woes

Binance is the number one exchange in the world for spot crypto trading, and much of its popularity comes from its impressive array of altcoins, deep liquidity and multiple exchange features. One of the biggest drawbacks to Binance is the regulatory scrutiny they are constantly facing, and the barrage of bans and regulatory red tape faced by the company as they are not legally registered in any country. This has made Binance a popular scapegoat and punching bag for regulators and governments all over the world who need to make an example out of crypto exchanges.

Just a Few of the Seemingly Never-Ending Binance Dramas Image via finextra.com

It seems that FTX has learned some lessons from the trials, tribulations and woes faced by Binance and were quick to set up their headquarters in Hong Kong which is a great first step and “green light” to help get some governmental and regulation scrutiny out of the way. If you have been wondering how FTX has made it on everyone’s radar so quickly they have managed to raise $900 million dollars in mid-2021 from over 60 VCs, firms and private investors and have been on an aggressive marketing campaign, purchasing the naming rights for the eSports organization TSM for $210 million dollars, the naming rights to an NBA stadium in Miami for $135 million, and a 5-year baseball sponsorship deal in the States. This aggressive marketing campaign has quickly launched FTX into being the fourth largest crypto exchange in the world.

When it comes to supported countries, Binance doesn’t make it clear who can or cannot legally use the exchange, and I don’t even think that they know themselves. It feels like they are still living in the wild western early days of crypto while other exchanges like FTX make it very clear that they are compliant with global crypto regulations.

Things are much more straightforward with FTX as they clearly state what countries can and cannot use the exchange. Users from the USA need to use FTX.US and personal accounts for users located in Cuba, Crimea and Sevastopol, Iran, Afghanistan, Syria, North Korea, or Antigua and Barbuda are not allowed to use the exchange, everyone else is good to go, leaving no murky uncertainties.

Location Restrictions Made Clear Image via help.ftx

Asset Support and Fiat Onboarding

Binance is the clear winner when it comes to the sheer number of supported crypto assets, though FTX holds up quite well in this regard, supporting over 250 coins which is more than enough for the average crypto user. As for fiat onboarding, both Binance and FTX are very international friendly supporting fiat payments from a host of countries though Binance takes the cake on this one supporting dozens of different currencies from exotic and lesser-known countries while FTX currently supports most of the major currencies. When it comes to deposits and withdrawals FTX allows for bank transfers, while Binance offers that and more such as credit/debit card purchases and P2P trading. While Binance does offer methods other than bank transfers I would always recommend using bank transfers as they are often much cheaper and will save you money in the long run.

Fiat Asset Support Image via help.ftx.com

Fees

At Binance the highest maker and taker fees users will pay are 0.1% which is tough to beat. Those fees can be further reduced by 25% for users who choose to pay fees using Binance’s own BNB token. Users can reduce those fees by another 20% if they sign up for Binance using the Coin Bureau sign up link. Those fees are already insanely low and they are very tough for other exchanges to compete with but somehow FTX has managed to remain competitive in that regard. Users who trade less than 2 million dollars every 30 days only pay 0.070% on Taker fees and just 0.020% on Maker fees. If you plan on placing a lot of limit orders, then FTX will be the better bet with those incredibly low maker fees. FTX users can further reduce those fees by holding FTT tokens for an additional trading fee discount. Users who sign up to FTX using our link will enjoy an additional 10% off for life and your first $30 dollars in fees covered, not too shabby.

FTX Tiered Fee Structure Image via help.ftx.com

Both Binance and FTX deserve serious kudos for managing to offer such low fees, those greedy banks could learn a thing or two.

There isn’t too much that needs to be covered in terms of platform navigation and use as both platforms are a breeze to use and the trading features themselves are both comprehensive and all-encompassing. You don’t become one of the top four exchanges in the world by having a shoddy user interface and both platforms are quite similar in those strengths. Customer support is something that many users do not often consider until they realize they need it, and there is nothing more frustrating than poor customer support, especially when your funds are on the line. Binance offers live chat support which is a huge convenience as they are normally quite quick to respond to issues, while FTX uses email ticket support, and users can reach out to them on social media platforms such as Telegram, WeChat, Facebook, and Twitter and users seem generally satisfied with the response times of the FTX admins on those sites.

FTX vs Kucoin

Kucoin is another popular exchange in the top four, you can find our in-depth Kucoin exchange review here. Kucoin is very well known and respected within the crypto community with a location-based out of Seychelles. Kucoin has established itself as a one-stop-shop for all sorts of crypto functions, offering the same level of service as the other major players such as Binance and FTX. Kucoin supports over 200 cryptocurrencies, over 400 markets, offers bank-grade security, an easy to use and beginner-friendly interface, margin and futures trading and a built-in P2P exchange.

Supported Jurisdictions

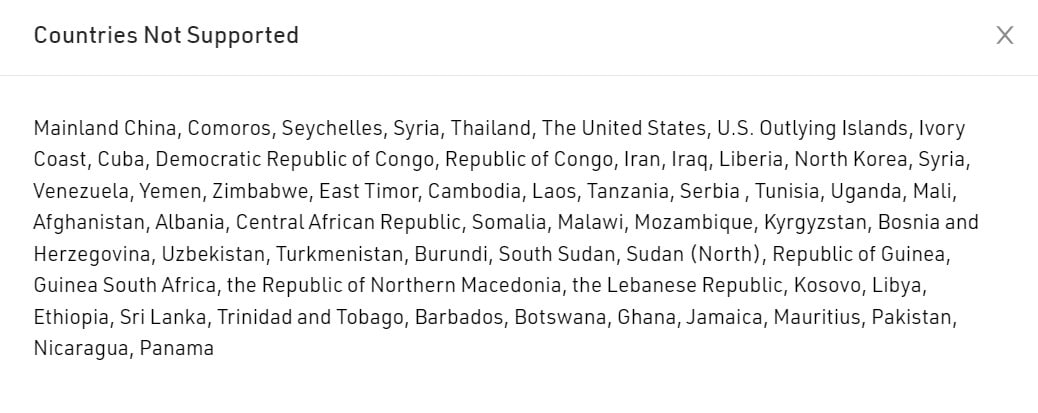

Similar to FTX, Kucoin is happy to comply with global crypto regulations and are clear as to who can and cannot use their platform. Kucoin has considerably more restrictions than FTX when it comes to unsupported countries as can be seen below:

List of Unsupported Countries Image via Kucoin.com

Asset Support and Fiat Onboarding

Kucoin gains the edge here when it comes to their impressive list of over 480 assets vs the 250 on FTX. Users need to go through a third-party company in order to purchase crypto with fiat on the Kucoin exchange, allowing users to pay by credit/debit card, Apple Pay, Google Pay and P2P. With all these options Kucoin has more convenient options to fund and withdraw, but not having the option to do direct bank transfers is a serious drag and this results in higher fees for depositing funds on the exchange and withdrawing so the edge here goes to FTX.

Fees

Kucoin has slightly higher Maker and Taker fees than FTX, with both Maker and Taker fees clocked in at 0.10% vs the FTX rock bottom fees hitting 0.070% for Taker and just 0.020% for Maker. The fees on both exchanges can be reduced by paying with and holding the exchanges’ native token. The trading fees on Kucoin can be reduced by 20% if users choose to pay fees in Kucoin’s KCS token and further discounts can be stacked up depending on how many KCS tokens are held can be seen below:

Kucoin Tiered Fee Structure Image via Kucoin.com

The edge here goes to FTX as users will avoid fees by both being able to utilize bank transfers and trading fees are also slightly lower for the average user. Users who prefer Kucoin can enjoy an additional up to 60% off trading fees, plus access a free trading bot by using our Kucoin sign up link here.

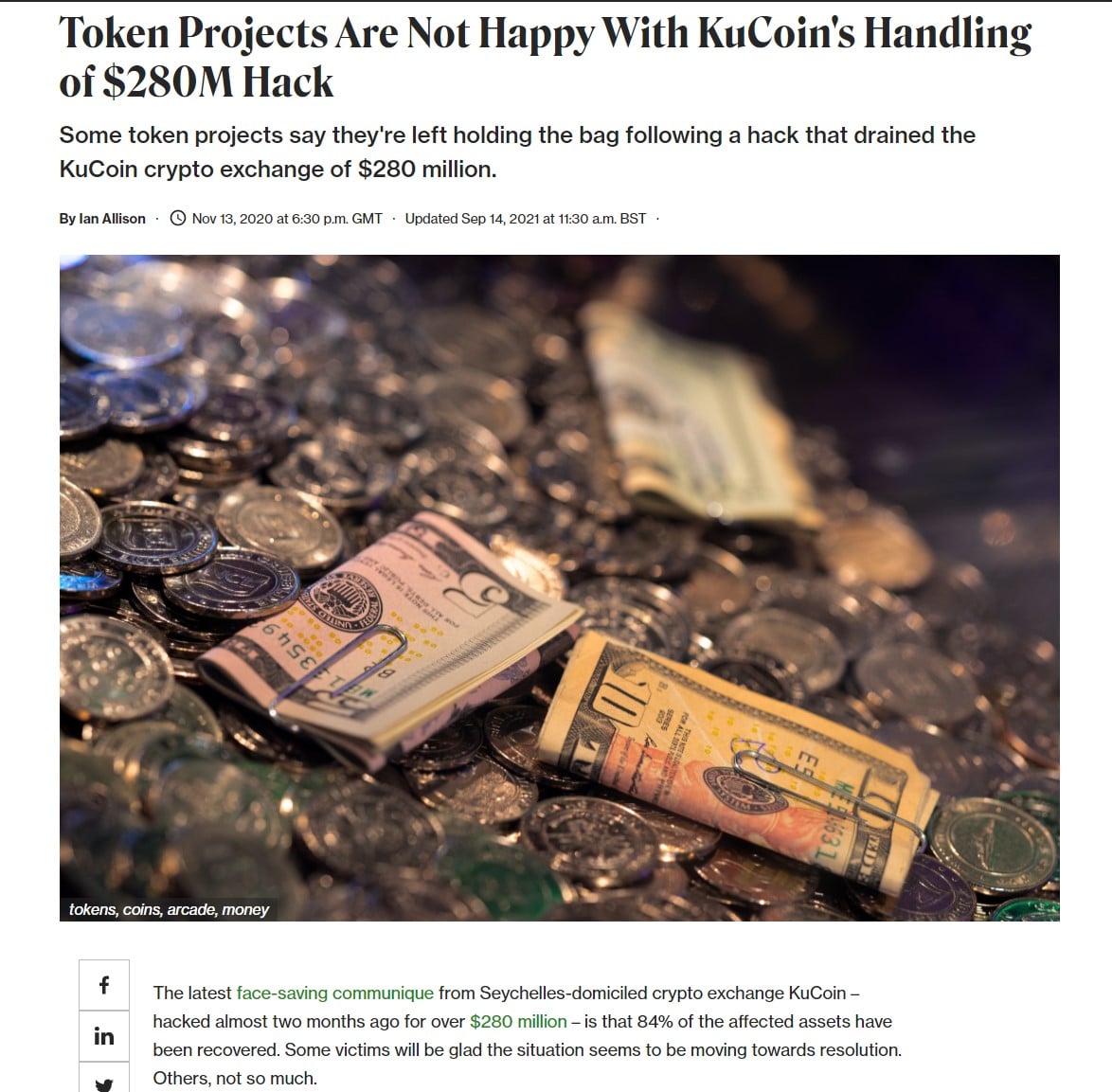

Kucoin isn’t quite as beginner-friendly as FTX which is fine for users who have been around the space a bit longer and have experience navigating crypto exchange platforms. FTX also has the advantage of having a thorough and robust self-help section with plenty of resources available to help users understand and use the platform. Kucoin also has knowledge base articles, but it would be nice to see that area filled out a little more comprehensively. It is important for users to note that Kucoin did suffer a hack in September of 2020, resulting in a loss of $280 Million USD. Fortunately, all the users’ funds that were stolen were covered by Kucoin’s insurance fund, though FTX still has an edge here as they have suffered no known hacks to date.

Kucoin Hack Resulted in 280M Loss Image via coindesk

As for support, the edge definitely goes to Kucoin here for the simple reason they offer 24/7 chat support in both the mobile app and website. They also offer support on popular social media sites similar to FTX.

FTX vs Coinbase

Unless today is your first day in crypto then you have likely heard all about Coinbase. Along with Binance, Coinbase is the other “OG” exchange in the cryptospace and is one of the most well established and regulation friendly crypto exchanges. Coinbase was founded in the United States all the way back in 2012 meaning they are ancient in the crypto industry but have aged with the grace of a fine wine which is why they have long since enjoyed being the second-largest crypto exchange. Be sure to check out our Coinbase exchange review where we do a deep dive here. So, how does this crypto legend stack up against the new “rising star” exchange FTX? Coinbase vs FTX head-to-head.

Supported Jurisdictions

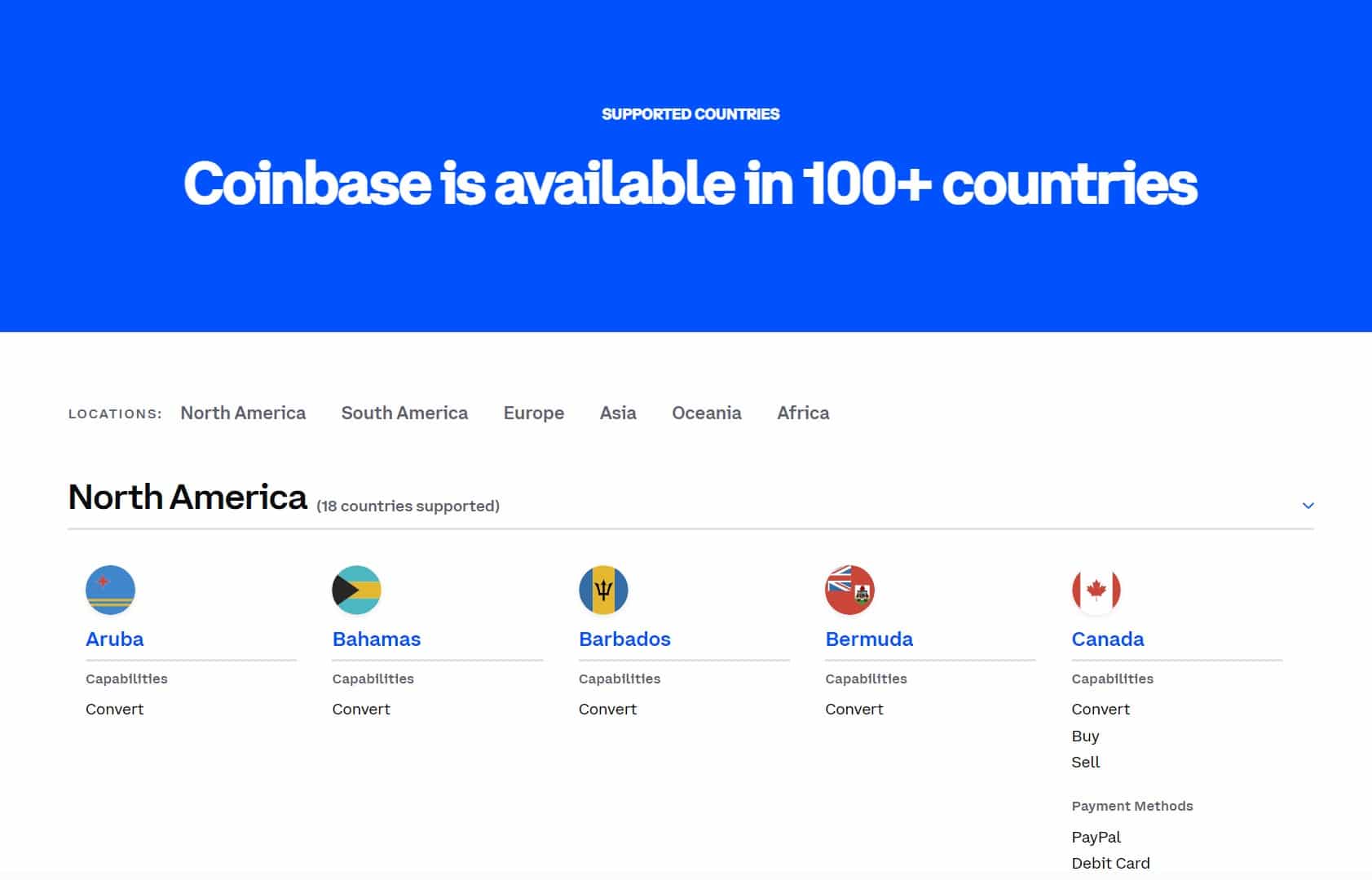

Coinbase is certainly more friendly for US-based user’s vs FTX as they are regulated in nearly every State and accept users from all States other than Hawaii. FTX’s response to this was of course the launching of FTX.US which is a great option for American based users. Outside the US, Coinbase is available in over 100 countries which is pretty darn impressive, a full list of their supported countries can be found here. FTX has the edge here as they support more countries than Coinbase and for them, it was easier to list the few countries they don’t support, than the hundreds they do. A list of countries not supported by FTX can be found here.

Coinbase Supported Country List Image via coinbase.com

Asset Support and Fiat Onboarding

Coinbase provides users with over 100 different coins and tokens while FTX allows users to hold over 250, making FTX preferable for rare altcoin enthusiasts. As far as fiat onboarding, Coinbase really needs to up their game on this one as they only support fiat deposits in USD, EUR, and GBP meaning users from outside those countries will need to pay fees to exchange their local currency to the supported currencies. FTX is the better of the two here as they support a wider range of currencies including many major currencies such as AUD and CAD and some more exotic currencies, a full list can be found here.

While FTX offers bank transfers, Coinbase has an advantage here as they also offer bank transfers but also offer Paypal and Debit/Credit card deposits for select countries. While Coinbase may be more convenient for deposit and withdrawal methods it is important to know that those conveniences come with a price as cashing out onto a card can set users back 3.99% in fees. Bank transfers generally tend to be the most cost-effective method here. Bank transfers using SEPA are often free which is much easier on the wallet.

Fees

When trading, Coinbase users start off paying a 0.5% percent on both Maker and Taker fees for trading under 10k. The higher the amount traded, the less you pay for fees on Coinbase as you can see on the chart below. One of the largest criticisms against Coinbase is that the fees are considerably higher than much of the competition, but I guess that is the price users are willing to pay to use a regulation friendly, secure and dependable crypto exchange that even provides insurance for certain user accounts. The highest fees users will pay on FTX are considerably lower (up to 7x lower!) as highlighted earlier in this article so the edge here undoubtedly goes to FTX for being easier on the wallet.

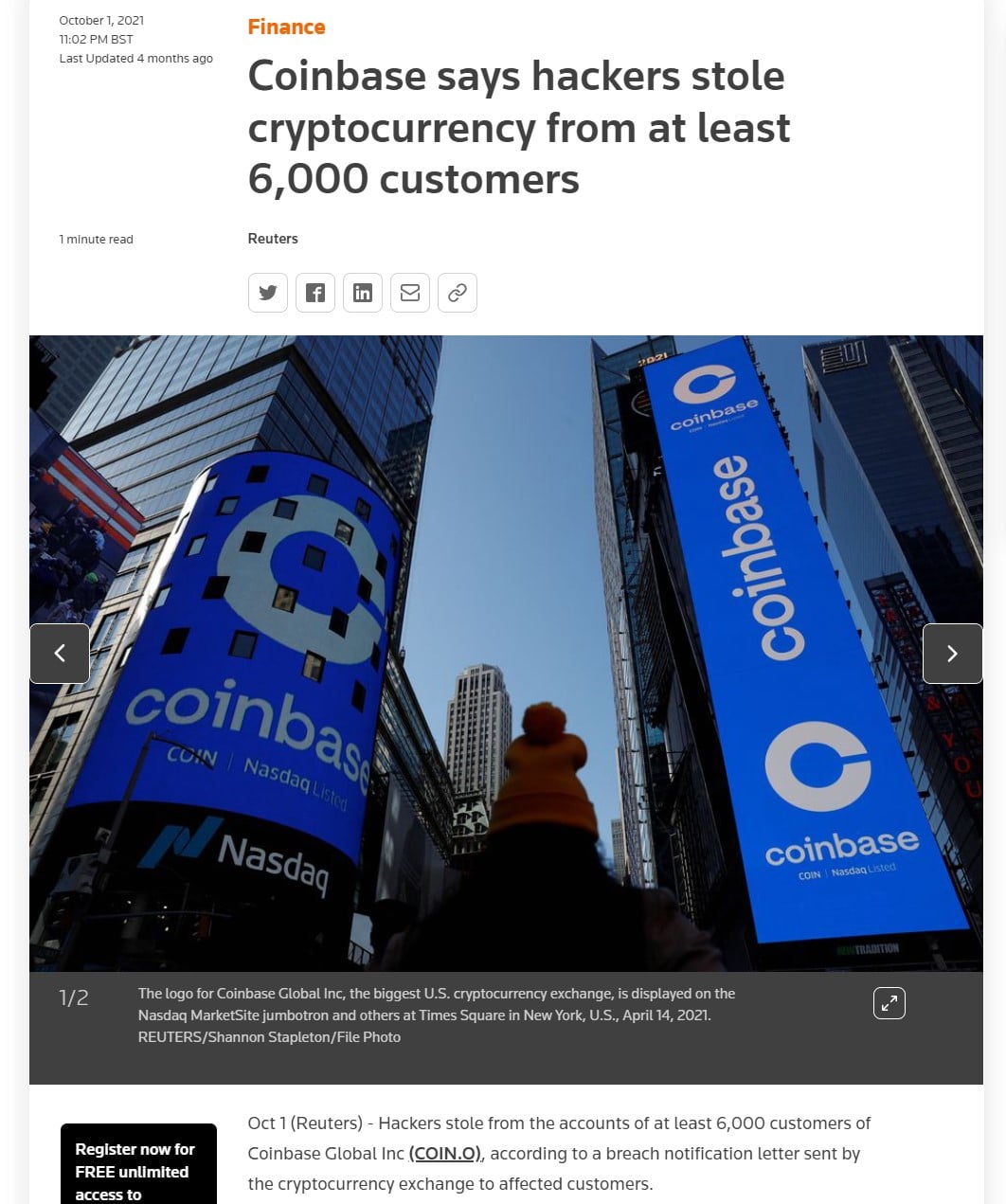

Maker and Taker Pricing Tier on Coinbase Image via help.coinbase

As with Kucoin and Binance, Coinbase also had an unfortunate hack incident in May of 2021 which resulted in funds being stolen from at least 6,000 users and this was made even worse by the fact that their customer support completely dropped the ball as these users were left to fend for themselves as many of them were unable to receive any form of customer support as Coinbase support was overwhelmed for days, if not weeks. FTX is the only exchange in this article that have not experienced a known successful hack so kudos to them. Luckily, Coinbase did reimburse all the users who had funds stolen though the incident did give the otherwise sterling Coinbase reputation a black eye.

Over 6,000 Customers Had Funds Stolen due to Hack Image via reuters.com

There is not too much of a difference between the platform navigation and layout as both platforms are incredibly beginner-friendly, intuitive and easy to use. The Coinbase platform looks and feels a bit less cluttered and cleaner which may be better for brand new users but neither platform have any glaring issues that need to be pointed out and they are both very well designed. As far as charting, both platforms offer robust and comprehensive trading and charting tools suitable to meet the needs of most traders so you wouldn’t be missing out if you chose either one. As far as support, as mentioned, Coinbase is often criticized for very poor customer support, something that they have been working at and improving. Both exchanges offer email ticket support, with many users complaining that they have had to wait for days or weeks to hear back from Coinbase while FTX can be reached across various social media platforms. For support, we have to give the upper hand to FTX on this one.

Conclusion

FTX came onto the crypto exchange scene with a bank, and it continues pushing ahead to try and become the largest crypto exchange in the world. Aside from that, we rate it as one of the best exchanges, despite its relatively short time in the industry. The exchange continually improves on its own features, and on those of competing exchanges. Traders are understandably impressed with the innovative products and services offered by FTX.

The reputation of the exchange has continued improving since its launch, partially because it has been one of the few exchanges to avoid downtime during times of market volatility. When other centralized exchanges have alienated clients with downtime, FTX has continued to provide unparalleled service.

Even their CEO is helping the exchange to shine. Sam Bankman-Fried comes across as an open and trustworthy person, which is a rare trait in the sometimes less than transparent world of cryptocurrency trading.

There’s also the unique products to be found at FTX, such as the leveraged tokens and the prediction markets. Granted the prediction markets are little more than gambling, but it can bring a breath of something different and fun to the sometimes stressful world of the trader.

FTX has rapidly positioned itself as a go-to exchange for many traders, and there’s a reason for that. The reason is that the exchange provides traders with what they’re searching for. It delivers on its features, on the strength of its platform, and in the security and liquidity that all of us need when trading.

FTX Exchange

Pros

Low Fees

Advanced Features

NFT Marketplace

Cons

Limited for U.S. Users

Customer Support needs Improvement